california nanny tax rules

Nanny Taxes in California California Minimum Wage. Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof.

Termination Of Lease Agreement Form Free Printable Documents Lease Agreement Lease Being A Landlord

I help companies navigate the maze of federal state and local laws governing the workplace.

. Household employees must be paid at least the highest of federal state or applicable local. To claim the credit the qualifying child must be under age 13 and. Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof.

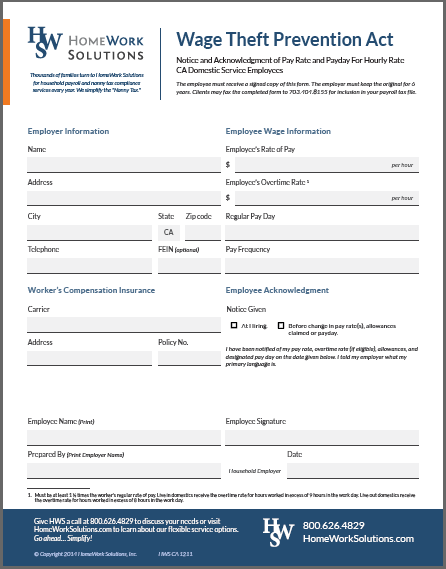

How To Fight Californias New Nanny State Law Banning Freelance Work. Visit the california tax service center taxescagov for federal and california tax information for businesses and individuals. For an employer with.

Tax labor and payroll laws vary by state for families hiring nannies and senior caregivers. Copy A along with Form W-3 goes to the Social Security Administration. This may vary if you have previous employees.

Hiring a domestic employee in California or have questions about complying with the states tax wage and labor laws. Families even the most well. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny.

You are not required to pay UI and ETT because the cash wage limit of 1000 in a quarter has not been met the value of meals and lodging is not included in reaching the 1000 cash wage. Nanny tax requirements by. California requires a new employer state unemployment insurance tax of 34 for the first 7000 wages paid to each employee.

A household employee is someone who does work in or around your. California has some of the most complex household employment labor laws in the country. MyIdea California Nanny Tax Rules.

This fact sheet contains information you need to know to comply with state and federal labor and employment tax laws - the so-called California nanny taxes. So complicated in fact that the California Household Employers Guide published by the state. Learn all the 2021 household employment rules you need to follow.

The nanny tax rules apply to you only if 1 you pay someone for household work and 2 that worker is your employee. The employer rates are available online at e-Services for Business eddcagovPayroll_Taxese. You cant claim a nanny on your taxes but you may be eligible for the child and dependent care tax credit.

The UI tax rate for new employers is 34 percent 034 for a period of two to three years. Get a free no-obligation consultation with a household.

1099 Vs W2 In California A Quick Legal Guide

10 Common Income Tax Snafus Infographic Olson Tax Consulting Llc Tax Mistakes Income Tax Income Tax Return

California Nanny Tax Rules Poppins Payroll

Can I Report My Employer For Paying Me Under The Table In California Workplace Rights Law Group

![]()

California Nanny Tax Rules Poppins Payroll

Chart Summarizing 2019 California Labor Law Labor Law Employment Law California

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor

Tax Law 101 A Helpful Guide For Ca Household Employers Educated Nannies

California Domestic Worker Bill Of Rights Employer Facts

![]()

California Nanny Tax Rules Poppins Payroll

California Nanny Tax Rules Poppins Payroll

California Payroll Taxes Everything You Need To Know Brotman Law

Co Tenancy Agreement Form Co Tenant Contract Sample Https 75maingroup Com Rent Agreement Format Power Of Attorney Form Contract Template Contract Agreement

How To Do Your Nanny Taxes The Right Way Marin Mommies